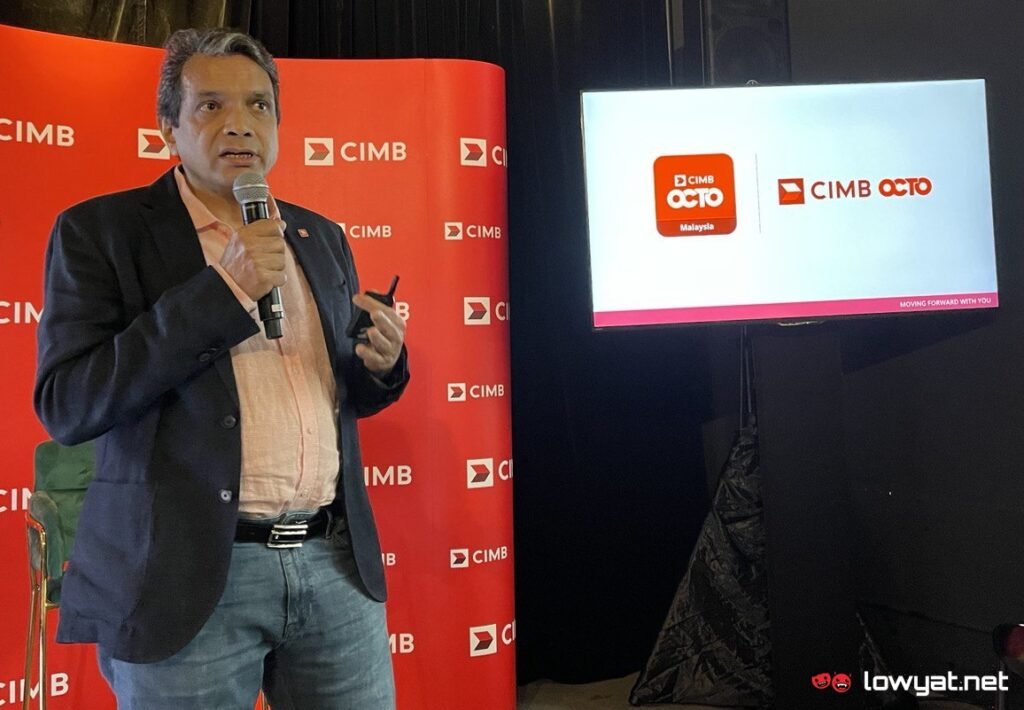

Prior to this, Effendy who has been with the group for the past 18 years, was the CEO of CIMB Digital Assets (CDA). This particular division is the home to Touch ‘n Go (TNG) and TNG Digital which are collectively referred to as the TNG Group. Being the Group CEO of TNG Group since October 2020, Effendy overlooks the day-to-day functions of both TNG and TNG Digital. At the same time, CDA also includes CIMB Philippines and CIMB Vietnam. Together with the appointment of Effendy, CIMB Group’s Consumer Banking and CDA will be merged together to form the new Group Consumer & Digital Banking division. Hence, he will continue to manage all four major businesses under CDA that we have mentioned earlier despite having the new CEO role. The merger of both divisions seems in line with the increasing digitalization of the financial world although the new Group Consumer & Digital Banking division needs to settle itself as soon as possible though. In many ways, the effectiveness of CIMB’s digital effort as well as customers’ satisfaction relies a lot on how well its digital services are able to serve their users. Over the years, the bank’s digital banking platform CIMB Clicks has been criticized for various reasons including prolonged downtime and security issue. On the other hand, CIMB earlier this year rolled out the new OCTO App which has injected some fresh vibes that the bank’s digital banking service badly needed. CIMB has planned to roll out the full-fledged version of its new OCTO App within the first half of 2023. Furthermore, the web version of OCTO is expected to be available for consumers in the latter part of the year as well which means it is going to be a rather busy time for the newly formed Group Consumer & Digital Banking division.