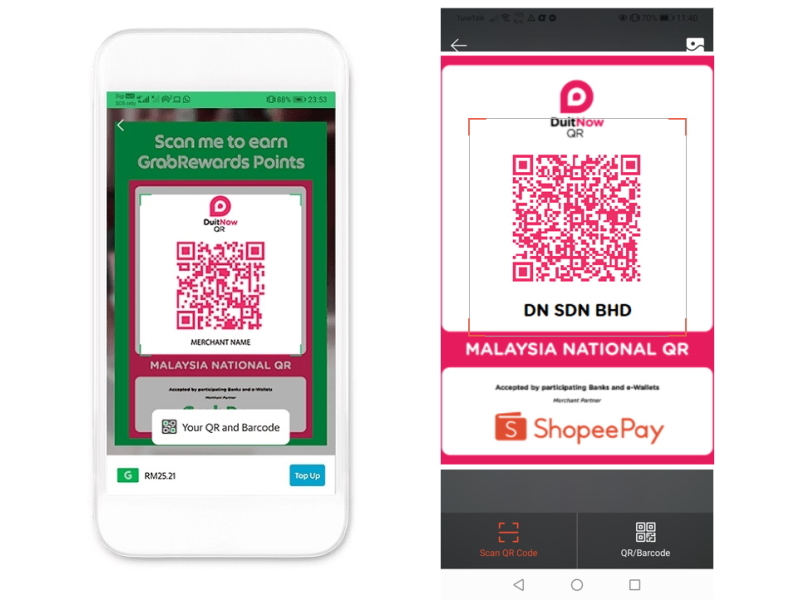

According to the joint announcement by Bank Negara Malaysia (BNM) and the Monetary Authority of Singapore (MAS), the linkage will allow for more seamless payments between both countries which BNM said has recorded RM 4.2 billion of remittances in 2020. The implementation will be done in a phased manner, starting from the fourth quarter of 2022. Aside from the phone number-based fund transfers, the linkage between both payment systems will also allow consumers to make payments at retail stores by scanning DuitNow QR or NETS QR codes. Theoretically, this means users should be able to utilise Malaysian e-wallets or banking apps for payments in Singapore once the implementation is completed. Prior to this, BNM has worked on seamless cross-border payments with the Bank of Thailand (BOT) since the middle of 2020. In fact, Thais were already able to make payments in Malaysia by scanning DuitNow QR codes after the first phase of the linkage between DuitNow and BOT’s PromptPay was completed back in June. On another hand, Malaysians can only perform Thai QR payments in Thailand later this year as this capability falls under the second phase of the linkage which will take place within Q4 2021. By the fourth quarter of 2022, mobile number-based real-time transfers will also be enabled between Malaysia and Thailand. (Source: Bank Negara Malaysia, Monetary Authority of Singapore.)